Press release

Press release

September 6, 2012

Multisectoral group Bagong Alyansang Makabayan (Bayan) today criticized the report of the Independent Oil Price Review Committee (IOPRC) and disputed its conclusion that oil companies are not overpricing the public and raking in excessive profits at the expense of consumers.

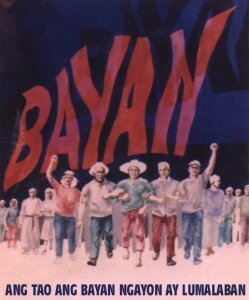

The alliance made the statement as its member-organizations trooped to the main office of the Department of Energy (DOE) in Taguig City to protest the IOPRC report, which it described as missing the fundamental issues in the deregulated Philippine downstream oil industry.

On Wednesday, the IOPRC released the findings of its study and declared that there is no truth to allegations of overpricing and accumulation of excessive profits by the oil firms. It also proposed that government continue to support the Oil Deregulation Law (ODL), which is supposedly achieving its goal of fostering competition and setting fair oil prices. The body even advised policy makers to consider deregulating public land transport as well to immediately compensate for rising fuel prices. The DOE set up the IOPRC last March to determine if oil companies accumulated excessive profits and if they were guilty of unfair pricing.

But Bayan countered that the IOPRC arrived at its flawed conclusions as it ignored repeated proposals by Bayan and other cause-oriented groups for the review body to closely scrutinize the linkage of the biggest oil companies in the Philippines with the world’s oil giants that assert monopoly control over the global oil industry. During the public consultations with the IOPRC, Bayan had pushed for an in-depth probe on international supply contracts between the global oil giants and their local units and affiliates to determine how much they buy their oil supply and under what terms. The group said that the biggest oil firms in the country – Petron, Shell, Chevron and Total, which together control more than 80% of the domestic market, buy oil from foreign partners or mother units abroad at much cheaper prices than published prices in Dubai and Singapore while imposing higher pump prices on the market that they control. Such monopoly pricing is compounded by the price-bloating effects of speculation by global banks, financial firms and the giant oil companies themselves.

In its updated estimates, Bayan claimed that as of July 2012, global monopoly pricing and speculation account for some 59% to 73% of global crude oil prices. The group cited data from the US’s Energy Information Administration that a barrel of crude oil can be produced with a cost of just $26.63 to $40.46 per barrel, which are way below the posted global price of Dubai crude, the country’s benchmark, of $99.22 per barrel, as of July. The difference of $58.76 to $72.59 per barrel between the estimated production cost and the posted price roughly represents the impact of global speculation and monopoly pricing. Such super-bloated global prices are directly passed on to Filipino consumers because of deregulation.

The group also expressed doubts that oil firms are faithfully reflecting global price movements in local pump stations as claimed by the IOPRC. Bayan said that based on its own tracking of the impact of monthly fluctuations in global prices and foreign exchange rate, diesel is overpriced by around ₱10.26 per liter, as of July. The group used the monthly movement of global oil prices and foreign exchange rates and their estimated impact on local pump prices from 1999 to the present, or the whole period under the current deregulation law (Republic Act 8479). From January to July 2012 alone, diesel has been overpriced by ₱1.64 per liter.

Bayan clarified that the said figures represent local overpricing only – or simply the disparity between monthly changes in global crude prices and domestic pump prices – and thus, do not yet capture the much bigger impact of speculation and monopoly pricing by giant foreign oil companies on petroleum prices.

The group said that it is not surprised by the IOPRC’s main findings, pointing out that the review panel is headed by one of the country’s leading advocates of unregulated, free market. Bayan said it will continue to push for effective regulation of the downstream oil industry and challenged Congress to act on pending bills repealing or amending the ODL. It added that it will release soon its own “people’s review” of deregulation and oil prices and disclose evidence that the ODL has created favorable conditions for further oil price manipulation and profiteering. #